Iran Press/ Iran News: As the coronavirus pandemic escalates, scientific communities worldwide call seriously for prediction of the post-pandemic situation, getting a grasp of probable economic consequences spawned by the long-lasting lockdown. Considering the elderly-selective impact of COVID-19, with the global death rate[1] of 35 % for patients over 60 years of age, a higher mortality rate would simply result in a more intensive flow of inheritance within the society. Cautiously, it brings forward Thomas Piketty’s notion to be, by all means, tangible that we are experiencing a shift toward a society with a greater number of “less-wealthy rentiers; a society of petits rentiers”. Thus, what if the current pandemic feeds the fire of wealth inequality owing to the paucity of victims from other age groups?

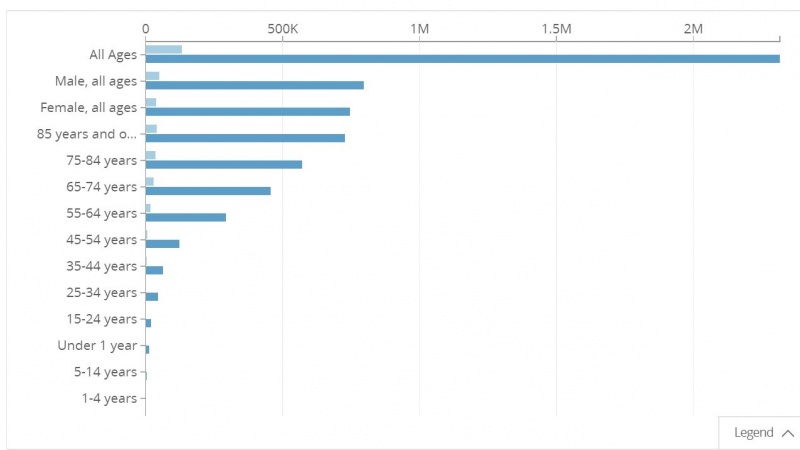

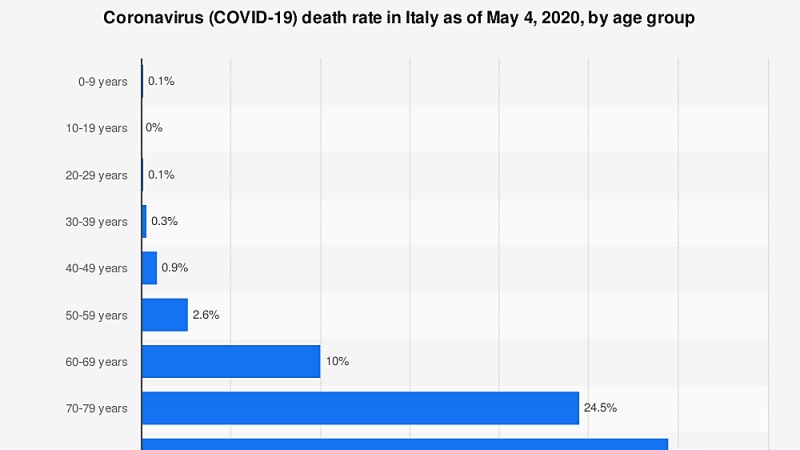

A clearer picture of Coronavirus and the challenges and opportunities confronting post-pandemic economies would emerge from an examination of the statistics concerning age patterns of the victims. As we can see in the charts below, more than 70% of deaths due to COVID-19 have occurred among 60+ age groups which means that current pandemic seriously pushed forward the death of potential wealth-leavers; to put differently, the nature of pandemic steer the course of infections and deaths to be concentrated at a certain time. So, the inheriting process for middle-age persons will be boosted to an unprecedented extent during the crisis. Furthermore, despite the negligible share of coronavirus death tolls in comparison to the total number of deaths within a year, a distinctive factor might enforce the inheritance effect abruptly. In the case of direct inheritance, if a descendant has a surviving partner, the share per person would be equal for children and the partner, while a middle-old (ages 75–84) COVID-19 victim is more likely to lose his/her partner within a short time because of the asymptomatic carrier pattern of the virus. As a result, wealth is expected to be immediately distributed equally between the younger generation; a tax-free lump sum dropped down, out of the blue.

Figure 1 COVID-19 death tolls in the U.S. by age and its share from deaths from all causes of death as of May 6, 2020 (Source: Data.cdc.gov)

Figure 1 COVID-19 death tolls in the U.S. by age and its share from deaths from all causes of death as of May 6, 2020 (Source: Data.cdc.gov)

Figure 2 COVID-19 death rate in Italy as of May 4, 2020 by age group

Figure 2 COVID-19 death rate in Italy as of May 4, 2020 by age group

(Source: Statista.com)

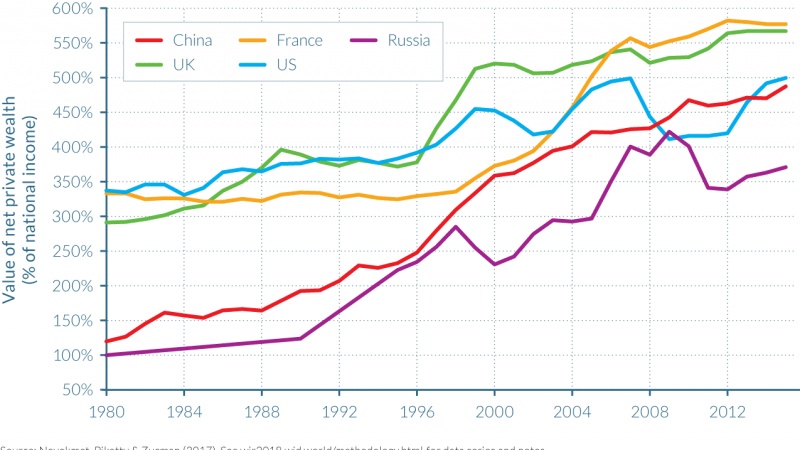

From the point of view of inequality, it matters whether the “private wealth” accounts for significant part of national income—as was often the case in France, U.K., and Italy— or whether it can claim a degree of balance. Following Piketty’s (2014) notion that wealth inequalities are not simply arbitrary contingencies, rather, there must be universal principles and patterns, which largely intersect with other social and economic settings, the wealth/income gap actually might dramatically worsen the provisional effect of inheritance disparities within countries. According to the chart, surprisingly, those countries with greater value of private wealth seem pretty much the same as those involved more severely in current pandemic in terms of both reported cases and deaths. For example, the U.K., the worst-affected country in Europe, with 35,044 deaths as of May 13, have ascended to the nearly highest ratio of private wealth to national income (i.e. more than 550 %). So, in the light of slowing pace of economic growth during the crisis, it is no wonder that a novel wave of inequality tees off by which it is all but inevitable at the end of the day that inheritance predominates savings come from the present capital(income).

Figure 3 Value of private wealth of national income

Figure 3 Value of private wealth of national income

(Source: World Inequality Database)

Moreover, once a pervasive remapping of population structures around the world is urged under the influence of COVID-19, another looming issue would be to trace the fertility rates as a decisive factor determining the degree of wealth inequality produced by age-specific deaths due to pandemic. Historical records demonstrate that almost every developed country esp. within Europe after the 1950s experienced a leveled-off rate of childbearing close to the replacement level. For instance, comparing two highly-affected countries during COVID-19, Iran, and Italy, regarding the total fertility rate (the estimated number of lifetime births expected per 1,000 women), an Italian victim of coronavirus with 60 years of age is likely to have four children less than his (or her) Iranian peer bearing in mind the long-standing high fertility tradition in developing countries.

Controversies may erupt over this problem in the wake of passive e?orts to respond to the post-pandemic society, holding that these consequences are utterly defenseless, truly unhelpful, and extremely retrospective within the crisis, so we shall develop regulatory arrangements upon them mostly with special “crisis time” considerations. But it matters, after all, what legal principles are invoked. Policymakers need to recognize certain regulations for inheritance as a compelling component of the ad hoc protocols adopted at different levels of government; For example, a suggestion implied by David Halpern (2014) when he claims that based on observations from U.K. ‘the correlation between one’s wealth and his descendants’ wealth becomes weaker as the number of separating generations gets greater due to the timing of inheritance’. One especially insightful suggestion would be the establishment of descendants’ trusts in which “the bulk of an estate is placed in a trust for the benefit of the grandchildren and great-grandchildren of the deceased”, instead of the first-hand property transfer.

Given the scale and scope of challenges the expected outburst of inequality might pose to central concepts on a larger context, a sustainable solution for such a critical aspect of pandemics seems actually much more like a perplexing one for those who have been concerning about inequality for the last decade or more. As a practical matter, using the potentials of disruptive technologies, support for a system of inheritance tokenization, based on blockchain technology, crossing national borders would greatly facilitate the expansion of the duration and timing of inheritance activation as well as its consumption. Something that with its multi-stakeholder nature will join together governments, industry, and civil society to ensure a sustainable, long-term, and multigenerational effect of heredity throughout the economy. The approach also provides an insightful chance to form a permissioned the market of exchange for inherited properties like a stock market whereby the asset, its profit, would be distributed steadily and more gradually.

Imad al-Din Payande is an inequality researcher at Sharif Policy Research Institute (SPRI), Sharif University of Technology, Tehran, Iran.

References

1. Halpern, D. (2014). The Hidden Wealth of Nations. Hoboken: Wiley.

2. Piketty, T., & Goldhammer, A. (2014). Capital in the Twenty-First Century. Harvard University Press.

104

Read More:

Inequality hikes; World's 22 richest men wealthier than all the women in Africa; Oxfam says

Anti-G7 protesters condemn growing inequality and destruction of the environment